Strengthening the Pillars of Free Press: Support the Society of Professional Journalists Foundation.

The free press is more than just an institution; it represents the foundation of our nation and the freedoms we cherish. Your support is not just appreciated—it's essential. With your help, we can ensure that the light of responsible journalism continues to shine brightly, illuminating the path forward for our democracy. Help us reach our year-end goal of raising $50,000.

Donate Today

Business matters

Keeping track of business

On Your Own: A Guide to Freelance Journalism

> Home

> Introduction: The freelance side of life

Freelance journalism 101

> Dressing for success as a freelancer

> Staying productive even when you’re not working

Business matters

> Five reasons to pay attention to business

> Contracts and copyright — beyond the basics

> Getting your business organized

> Separating yourself from your business

> Insurance considerations for freelance journalists

Making a living

> A simple way to boost your pay: Ask

> Retirement planning: Where to stash your cash?

Finding work

> Inspiration for finding the story

> Brainstorming ideas you can sell

> Pitching your way to a full story calendar

> Tips on freelancing for newspapers

Marketing yourself

> Paying attention to business

> Making a home for your business on the web

> Networking: the key to staying happy and fed

> Business cards help make the best first impression

Tools of the trade

> Why journalism ethics matter

> Four tips for better self-editing

> Selected websites for finding freelance journalism assignments

There’s no single “right” recordkeeping system for freelance journalists. Some freelancers have elaborate bookkeeping software that allows them to track revenue by client, subject matter and type of work and expenses by categories and subcategories. Others have very simple systems set up in spreadsheets and word processing software.

How much detail you need in your bookkeeping system depends on why you’ve decided to keep records. To figure out what system is right for you, whether a simple balance sheet of income and expenses or a software system updated weekly or monthly, first think through what you intend to use the information in the system for. For example:

• Is your expected profit so small that you only need to know about financial matters at the end of the year to file your tax return? Or do you need to figure your profit each quarter and pay estimated taxes to the state and federal governments?

• Do you want to know how much money you expect to receive over the near term based on work you’ve already completed?

• Are you trying to figure out how to improve your net profit or how to spend less time working and more time doing things you would rather do?

• Do you want to make it easier to figure deductions and business expenses at tax-filing time?

Whatever your business goals, they will affect your choice of recordkeeping systems.

Tracking productivity and business results

Many freelancers track billings and revenue, just as other business executives do, to make it easy to review their results periodically and make strategic decisions based on their goals for the year. Thinking about your goals will help you decide what you need to track.

Here are some measures to consider tracking:

• Type of work. Some freelance journalists offer an array of services, such as writing, editing, photography, desktop publishing and consulting. Tracking revenue and time by type of service can be helpful when deciding whether to buy new equipment or software. Knowing how much time it takes, on average, to provide editing services at different levels (i.e., basic, structural or developmental) will help you set rates to quote or decide whether you can afford to accept the rate offered by a potential client.

• Subject matter. Whether you specialize in a single business niche or have a diversified skill/knowledge set, you might find it helpful to know how much time you spend or revenue you get from certain subject matter. If your personal finance clients pay the most for an hour of your time, for example, you might spend more time looking for new assignments in that field. If your health insurance customers assign more stories related to individual insurance than to Medicare, your time (and money) might be better spent covering a conference on the health insurance exchanges than one on supplemental insurance for seniors.

• Client. Keeping track of how much time you spend working for a client and how much revenue that client brings in gives you a wealth of information. For example, if your income is overly reliant on one client, you might consider diversifying your customer base. If a client contributes a significant portion of revenue to your business each year, you might decide to make time for a last-minute assignment for that client you were thinking of declining.

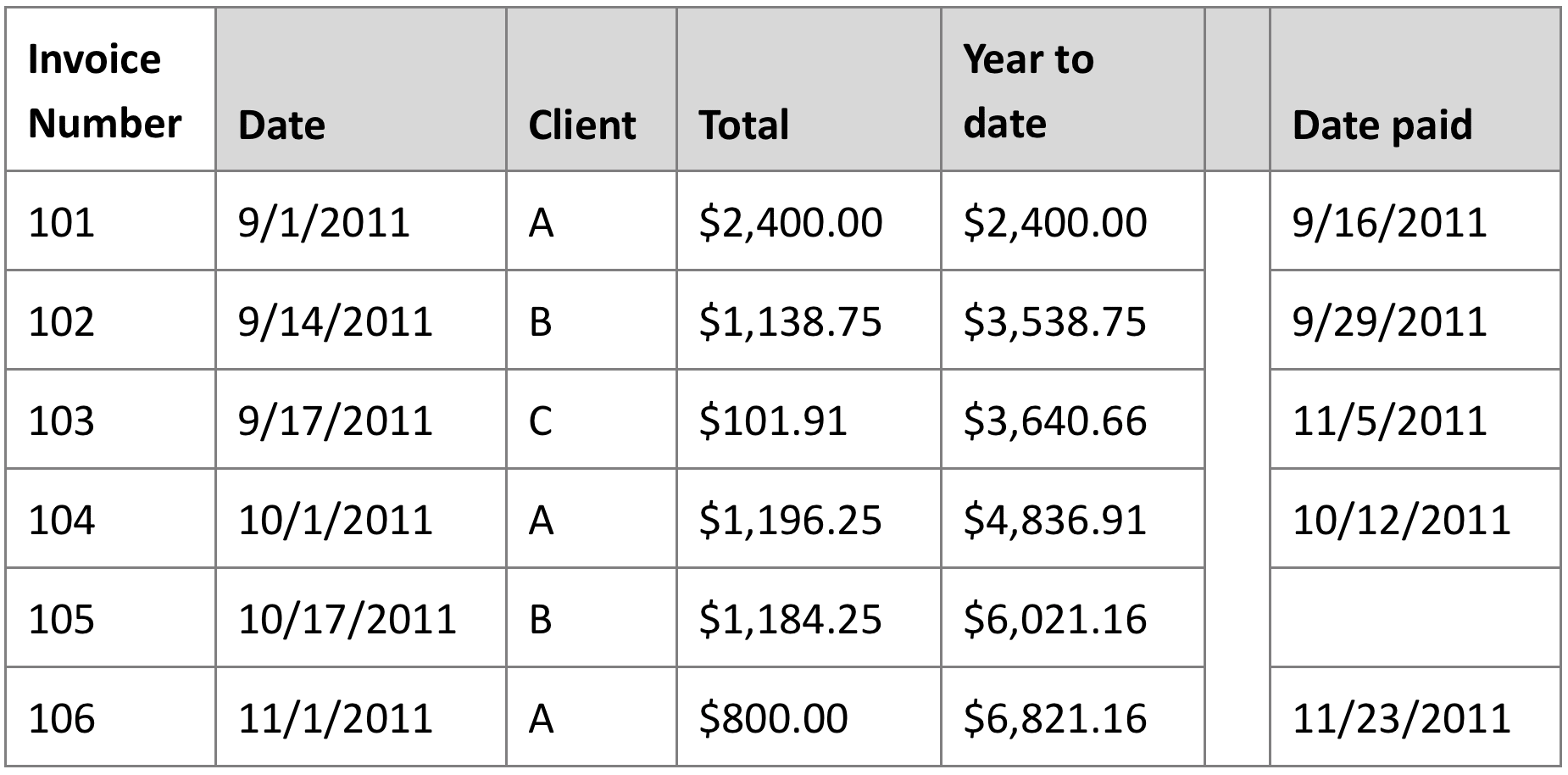

• Payment status. If making money is your goal, adding up the amount you have invoiced and been paid gives you a good idea of how productive you have been. If cash flow is more important, knowing what you are owed can help you plan for the next few months.

Putting all this information together will allow you to do some serious business planning. If you have a seasonal client base, that will show up in reports of how much you have invoiced per period (month or quarter) in each subject, for each client, and how quickly they pay. If you know dry times are coming, you might brainstorm about what other subjects are less likely to be affected by the calendar and pitch story ideas to clients in that field.

Do you know which clients owe you how much money and how long ago you sent invoices or statements to them? If your top two customers take longer than others to pay, you might try to intersperse quick-and-easy small jobs among theirs to improve your cash flow.

Recordkeeping for tax purposes

Whether you use bookkeeping software or a homemade system, your plan needs to help you track both sides of the tax return — income and expenses. Even if your only purpose for keeping records is to make it easier to file tax returns, throwing everything into a shoebox or file folder and adding them up at the end of the quarter or year probably isn’t the best system.

On the income side, you can keep a simple tally of the money you’re paid. If you have a separate bank account for your business, deposit all freelance payments into it and don’t pay personal expenses out of it, you might choose to add up your deposits at the end of the year to come up with a revenue figure. This includes payments clients are required to report to the IRS on Form 1099, as well as other miscellaneous revenue. (Any client that pays you $600 or more in a calendar is required to file a Form 1099 with the IRS, so the IRS will know roughly what you make from your freelance business.)

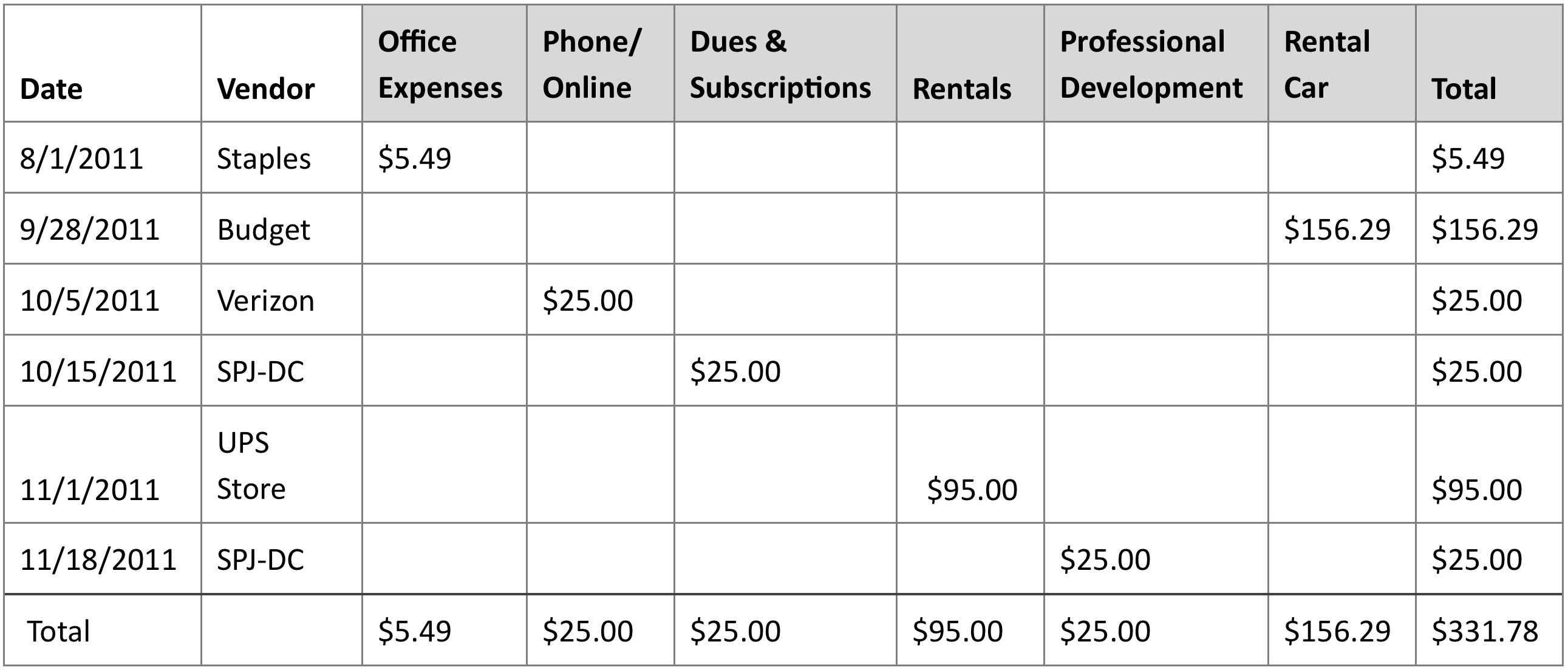

The easiest way to keep track of expenses for tax purposes is to divide them into the categories the IRS asks for. No matter which tax form your business files, you will find it helpful to track these expenses:

• Business development (advertising, website hosting and design, business cards, pamphlets, résumés)

• Business fees and taxes (license fees)

• Car and truck expenses (mileage, parking, tolls)

• Meals and entertainment (local and away from home)

• Equipment purchases, repairs and maintenance

• Insurance (business liability policy, travel evacuation insurance, home office rider)

• Interest (i.e., on a business loan or credit card used exclusively for business)

• Office expenses (telephone — business portion only, postage, printing, paper, ink)

• Professional services (lawyer, accountant, transcription)

• Rent and lease (office, equipment, vehicles, storage, mailbox)

• Travel (air, train, bus, hotel, incidentals and local fares away from your office)

Most tax forms have a listing for “Other expenses,” where you can report dues and subscriptions, professional development, and Internet access, among other miscellaneous expenses.

(See the Taxing matters section for more information.)

Recordkeeping systems

Some freelancers use small-business accounting software programs to keep their business books. These programs can be expensive, but they do have advantages, such as offering templates for estimates, invoices and monthly statements; downloading data from financial accounts and reconciling bank statements; and generating business planning reports in whatever categories of information you need to consider. Some also have time-keepers to help you track how much time you spend on specific assignments and tasks.

For many freelance journalists with no payroll or inventory, a homemade system using word processing templates and spreadsheet software will suffice. Templates for use with office software are readily available for download on the Internet.

Invoices are the first step to tracking income and accounts receivable. Once your templates are set up, using your business logo and contact information, it will be easy to generate an invoice for each assignment, or one a month for each client, as soon as work is complete or when you have reached milestones you and the client have agreed will be payment points. Then you can list invoices in a file or spreadsheet and record each payment when received.

If you send monthly statements, a glance at the unpaid invoices listed in these files will show which clients need to be billed and how much they owe.

A spreadsheet or word processing table also can be used for expenses. Start with a column for each IRS expense line you expect to use.

Your planning goals may indicate that you need to break out some expenses separately. For example, if you offer desktop publishing or data visualization services that mean you need to print out material for a client, you might want to know how much you are spending on ink.

Generally, though, there’s no need to add unnecessary details to your business records. Keep it as simple as you can while still getting and recording the information you need.

Contributors: Hazel Becker, Dana Neuts

Last updated: January 2015

Copyright © 2012-2018 by Society of Professional Journalists. All Rights Reserved.

Questions or comments? Please post them in the Freelance Guide Comments forum of the Freelance Community Board or email [email protected]. We'll answer as soon as we can!